The introduction of this tax made Malaysia the second country in Southeast Asia to do so. KPMG Tax Remote Online Learning Series.

International Shipping To Malaysia A Guide For Ecommerce Merchants Janio

When shipping a package internationally from United States your shipment may be subject to a custom duty and import tax.

. However the amount of duty rates charged in advance by different movers vary. Always perform background checks. For item cost in a country of delivery.

Plus since the customs site got revamped to prepare for GST implementation a lot of old links not really working already If you really wanna be 100 sure make a phone call to ask the customs centre to avoid getting hit by unknown. Every country is different and to ship to Malaysia. The ordinance was repealed by the Income Tax Act 1967 which took effect on 1 January 1968.

Demystifying Malaysian Withholding Tax. Sales tax and service tax will be abolished. In many cases the average duty rate is around 6.

Item cost in a gift catalog. Dutiable shipments are subject to a customs duty which is a tariff or tax imposed on goods when transported across international borders. Some goods are exempt from duties such as electronic products like laptops and electric guitars.

No refund will be given for cancellations received less than 7 working days before the event date. 15-20 average Total estimated gift cost. Food standards in Malaysia are currently regulated by The Food Act 1983 and the Food Regulation 1985.

There are a number of factors that can affect the amount of customs duty owed on an item including. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of goods.

Egg in the shells. The calculation of duties depends on the assessable value of a dutiable shipment. Be sure to include all necessary information on your commercial invoice since this is how customs authorities will classify and.

For the purpose of this calculation dutiable goods are given a classification code that is known as the Harmonized System. Up to 80 cash back Duties Taxes Calculator to Malaysia. Use a gift delivery service.

Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry. In Malaysia the import duty rates can range from as low as 0 to as much as 50. Getting the required documents in advance is vital if you want to avoid hold-ups at the border.

Sales tax administered in our country is a single-stage tax charged and levied on locally manufactured taxable goods at the manufacturers level and as such is often referred to as manufacturers tax. Generally here are the three key points to remember when youre faced with any suspicious activity or potential scams. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent.

The Sales Tax Act 1972 came into force on 29 February 1972. Print and paste the shipping label which contains the information youve entered in the previous step securely onto the parcel. Agricultural and food products.

230 USD delivered in 1-3 days with delivery confirmation by email In summary it may cost 15-25 more to use a gift delivery service however the gift is guaranteed to be. The tax is also imposed on taxable goods imported into the Federation Sales tax. Print the shipping labels and documents and attach them to your package.

Its only charged on the services offered online that requires a payment to be made to the foreign company. Live animals-primates including ape monkey lemur galago potto and others. During colonial rule the British introduced taxation to the Federation of Malaya as it was then known with the Income Tax Ordinance 1947.

Any customs fees will need to be paid by the recipient. First we try to explain why this tax is a necessary evil Everyone dont worry so much yet its not going to be charged on ALL the transactions made online. Whether the scammer is claiming to be a government official a business or bank representative a relative a friend or a love interest stay calm and vigilant.

It is essential to provide local contact information so the recipient can be contacted by customs. Malaysia is a member of the British Commonwealth and its tax system has its roots in the British tax system. The indirect taxes such as GST are administered by the Royal Customs Malaysia one of the government agencies of the Ministry of Finance and collection of duties and taxes are mandatory duties of the custom.

Sorry if the site looks off its kinda difficult finding proper sources online about malaysian customs stuff. Estimate your tax and duties when shipping from United States to Malaysia based on your shipment weight value and product type. More information on import declaration procedures and import restrictions can.

All items sent via Parcel Monkey are DDU which means the duty is unpaid. Currently Sales tax and service tax rates are 10 and 6 respectively. The addresses and bar-codes on the shipping label must be in clear view for identification and customs inspection.

GST will not be imposed on piped water and first 200 units of electricity per month for domestic consumers and.

Tile Sticker Kitchen Bath Floor Fireplace Waterproof Etsy Uk Suelo De Linoleo Pegar Baldosas Calcomanias De Vinilo

Tile Sticker Kitchen Bath Floor Wall Waterproof Removable Peel N Stick W010navy

Lcd Bluetooth Headphones With Mic Fm Radio Tf Card Slot 6 Colors Wild Wireless World In 2022 Bluetooth Headphones Wireless Headphones Headphones With Microphone

Incorrect Pronunciations That You Should Avoid Learn English Phonetics English English Language Learning

All You Need To Know About Malaysia S Import Taxes Dhl My

Shipping To Malaysia Services Costs And Customs

Tile Sticker Kitchen Bath Floor Wall Waterproof Removable Peel N Stick A67 In 2022 Tile Stickers Kitchen Wall Waterproofing Peel And Stick Floor

Tile Sticker Kitchen Bath Floor Wall Waterproof Removable Peel N Stick A65

Tile Stickers Decal For Kitchen Bathroom Back Splash Or Floor Bx311b Charcoal Dark Gray

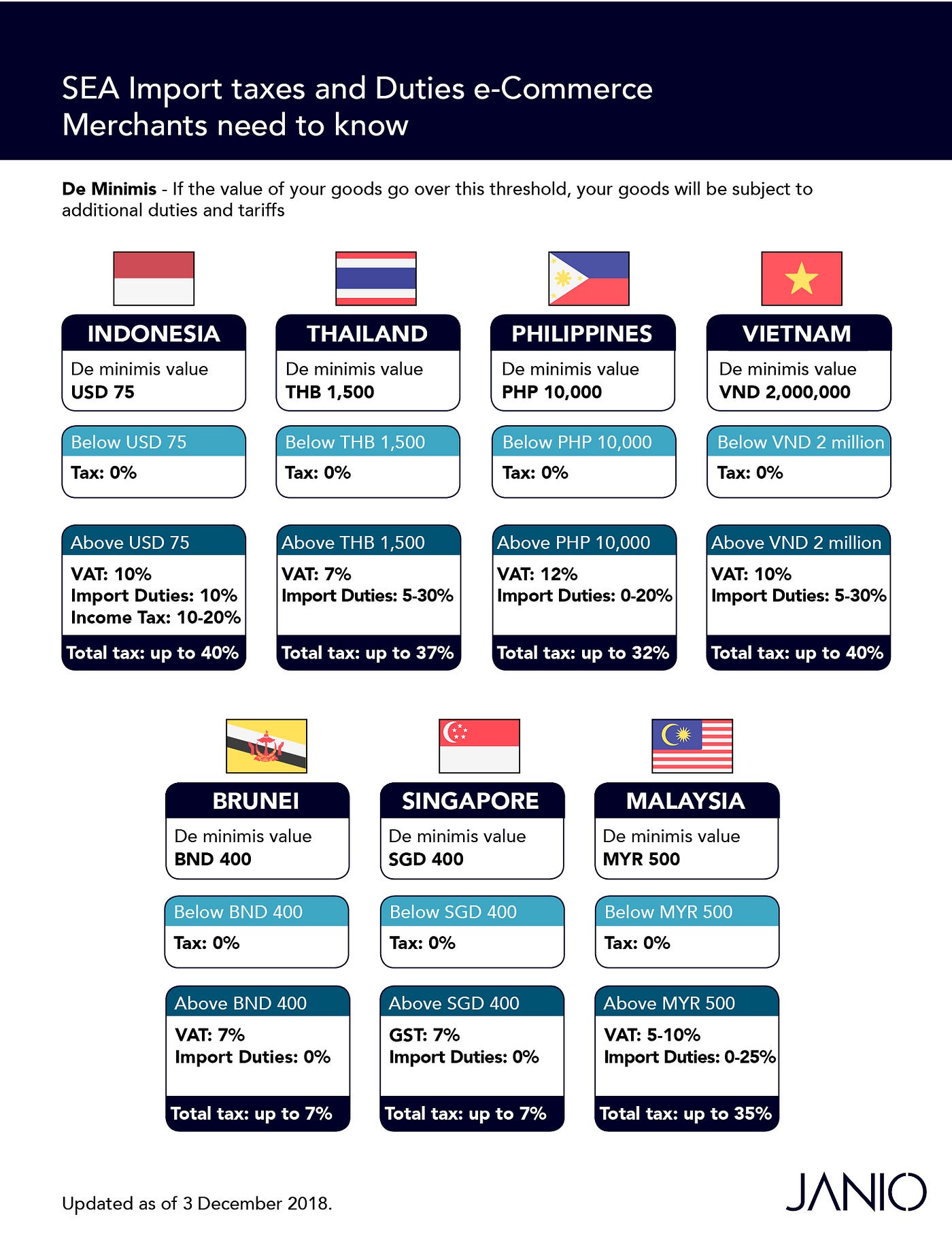

Customs Clearance In Southeast Asia Guide For B2c E Commerce Business By Janio Content Team Janio Asia Medium

What Items Are Duty Free At Malaysian Customs And What Asklegal My

4 Advantages Of Sea Freight Airfreight Logistics Supply Chain

Top Ten Mistakes To Avoid When E Filing Form 2290 Online For Ty 2020 21 Irs Forms Irs Employer Identification Number

Malaysia Free Trade Zones All You Need To Know Tetra Consultants

Customs Clearance In Malaysia Duties Taxes Exemption

Difference Between Fcl And Lcl

Import And Export Procedures In Malaysia Best Practices Asean Business News

Tile Stickers Vinyl Decal Waterproof Removable For Kitchen Bath Wall Floor M027n